India's Big Tax Reform: How Gst 2.0 Will Shape India's Economic Future

-

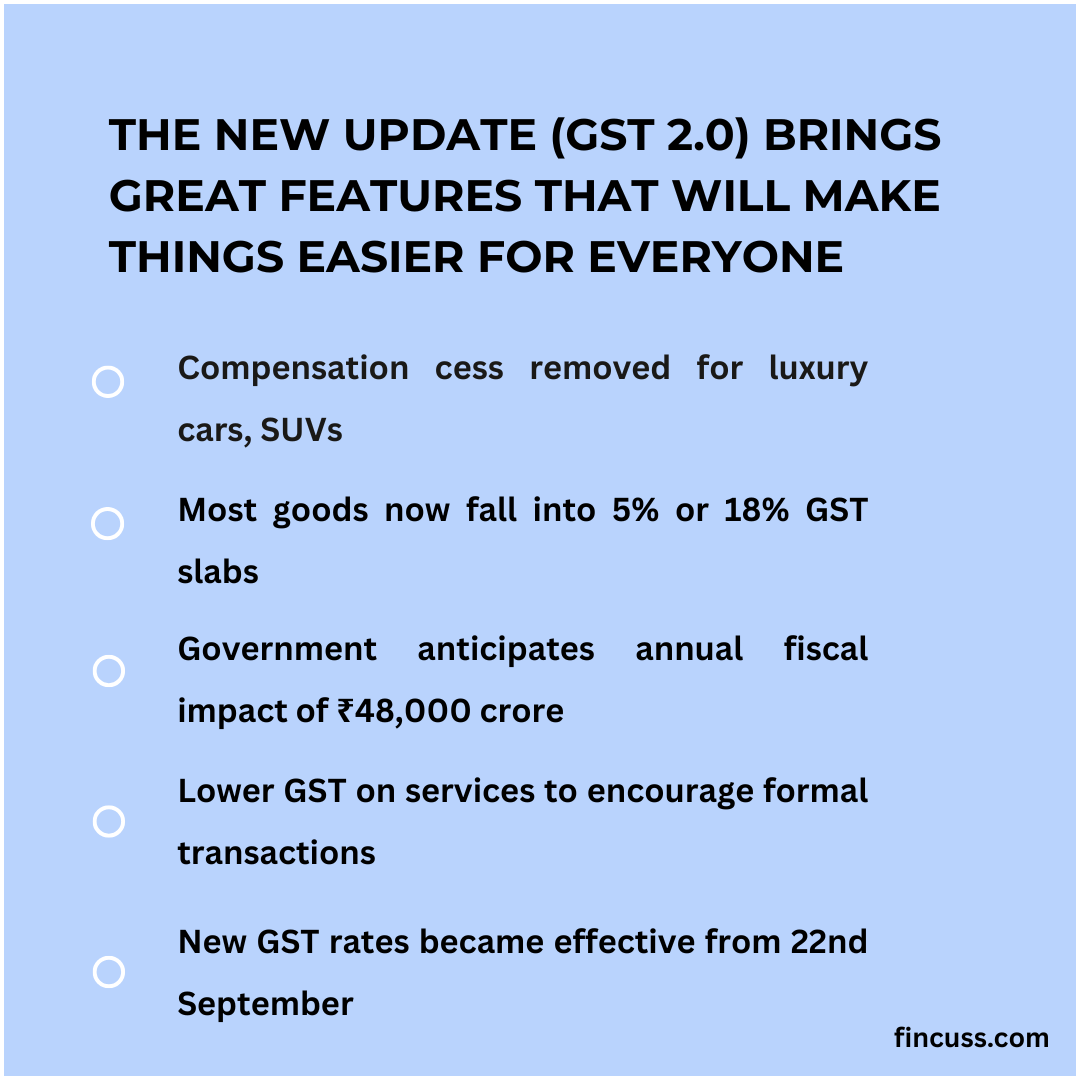

GST 2.0 is on the way in India, bringing exciting changes to the Goods and Services Tax. The government is implementing adjustments aimed at providing relief to citizens.

Here's the scoop: We used to have just two GST rates — 5% and 18%. But now we're leveling up to four rates: 0%, 5%, 18%, and a brand-new 40%.

This all kicks off on September 22nd, and it might change the prices of everything we buy, from groceries to cars.

Breaking Down the New GST Rates

Here’s how it looked before with our GST rates: 5%, 12%, 18%, and 28%. Now it’s much simpler:

-

0% GST: This applies to essential items such as lifesaving medicines, health insurance, school supplies, and basic food items like bread and roti.

-

5% GST: This covers a variety of goods that were previously taxed at 12% or 18%. It’s just slightly more than the essentials.

-

18% GST: This is now the standard rate for most items, combining products that used to be taxed at 12% and 28%.

-

40% Special Tax: This new high rate applies to luxury items and products that the government deems are not beneficial for us.

More Money Left in Your Pocket!

The whole idea behind this is to save you some cash!

Health & Wellness

Life and health insurance premiums are now at 0% GST — awesome, right? Medical-grade oxygen and diagnostic kits are dropping to 5%, and lifesaving drugs will remain at 0%. Those fancy glasses and contact lenses? They were taxed at 28%, but now it's just 5%.Everyday Essentials

Items like hair oil, shampoo, soap, and toothpaste now have only 5% GST. Even shaving cream and kitchen tools will cost a bit less. Good news for the kids — bicycles are getting a tax break! Dairy products like butter and ghee might be taxed at 5% or even 0%. Instant noodles and bottled water will also be 5% or less.Cars and Bikes

For smaller cars and bikes, GST is now just 18%. Electric vehicles still enjoy a low rate of 5%. But bigger SUVs and luxury cars? They’ll carry a 40% tax, down from 43-50%, making it a bit easier on the wallet.Home & Building

Cement is now at 18%, down from 28%. Marble and bricks are dropping from 12% to 5%. If you're thinking of building a house, now is a great time!Electronics & Gadgets

Items like air conditioners, TVs, fridges, and washing machines, which were seen as luxuries, now have a lower GST of 18%.Fun & Leisure

Staying at a hotel costing under ₹7,500 will now only be taxed at 5%, instead of 12%. Dine at a five-star hotel, and you'll pay an 18% tax instead of 28%. Beauty services, gyms, and health clubs are now subject to just 5% GST. And hey, movie tickets are dropping to 5% from 12%! Plus, educational items for kids are now tax-free at 0% GST!What's the Deal with the 40% Tax?

While many things are getting cheaper, some items will see a price hike. The 40% tax is aimed at luxury and "sin goods" that the government considers excessive or harmful.

Here’s a heads-up on what might cost more:

- Super fancy items like yachts and private jets will be hit with that 40% GST.

- Larger cars and motorcycles will feel the sting too.

- Tobacco products, such as cigarettes and chewing tobacco, will also carry that 40% tag.

- Sugary drinks and sodas will see a price increase because of the 40% tax.

- GST on coal is going up from 5% to 18%.

- Some fun events, like IPL matches, will now also have a 40% GST.

Wider Impact

These changes aren't just about our shopping — they could really shake things up in the economy and stock market too:

- The government slashing taxes on essentials aims to boost spending, which could help the economy grow.

- Lower GST on items like TVs and cars might help businesses thrive.

- However, the government could lose around ₹48,000 crore to ₹2 lakh crore in revenue for a while.

- The hope is that as people start spending more, they can quickly make up for the loss.

What This Means for Businesses

- Industries like FMCG, insurance, and small vehicles expect better profits.

- Insurance sector benefits from 0% GST.

- "Sin" category industries face challenges due to 40% tax.

- Uncertainty exists about whether lower GST rates will lower prices for consumers.

- Some prices may remain unchanged, benefiting manufacturers.

- Electronics might see actual price drops with different GST rates.

Overall, Good Vibes Ahead!

In a nutshell, these GST 2.0 changes look really promising for all of us in India, as they’re cutting costs on everyday items. The tax system is becoming easier to understand and is focusing more on health and education, which should give the economy a nice little boost. We’ll just have to keep an eye out to see how manufacturers adjust their prices. That 40% tax is aimed at specific products, so let’s wait and see how it all plays out!

-

-

-