Zerodha Vs Groww : Choosing the Best Broker for Your Investments

-

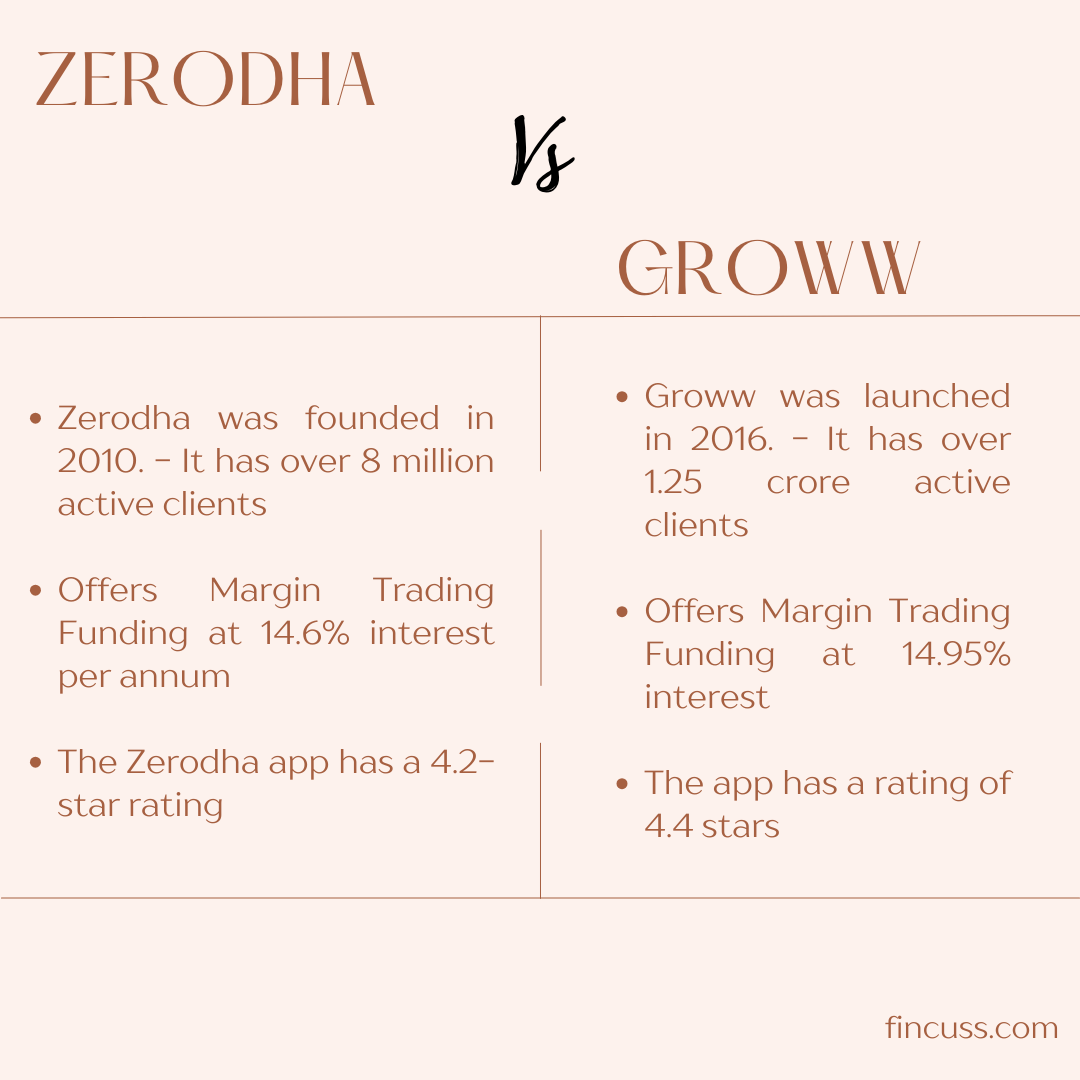

Deciding which stockbroker to trust with your investments can be daunting, but two names frequently come up in India: Groww and Zerodha. Both are prominent discount brokers that offer a range of services without the advisory typically found with full-service brokers. Let's break down their offerings to help you make an informed choice.

Getting Started: Account Opening & Maintenance

Good news for new investors! Opening a Demat account is free with both Groww and Zerodha. However, their annual maintenance charges (AMC) differ:

• Groww: Boasts zero annual maintenance charges, making it a cost-effective option for many.

• Zerodha: Charges vary based on your holdings. It's ₹0 AMC for holdings under ₹50,000, ₹100 + GST annually for holdings between ₹50,000 and ₹200,000, and ₹300 + GST annually for holdings over ₹200,000. Note that one source also mentions ₹75 + GST quarterly, totaling ₹300 + GST yearly.

Brokerage Charges

This is a critical area where differences emerge:• Equity Delivery (Long-term Investments):

◦ Zerodha: Offers zero brokerage for equity delivery trades.

◦ Groww: Charges 0.1% or ₹20, whichever is lower (with a minimum of ₹5 and a maximum of ₹20).• Equity Intraday (Day Trading):

◦ Zerodha: Charges 0.03% or ₹20, whichever is lower.

◦ Groww: Charges 0.1% or ₹20, whichever is lower.• Futures & Options (F&O) Trading:

◦ Groww: Charges a flat ₹20 per order for derivatives.

◦ Zerodha: Charges 0.03% or ₹20 for futures trading and a flat ₹20 per order for options trading.Other Essential Charges

Beyond brokerage, consider these:• DP Charges (Demat Participant charges when selling delivery shares):

◦ Zerodha: ₹16.5 (inclusive of GST). One source also mentions ₹13.50 + GST.

◦ Groww: ₹20 (inclusive of GST). One source also mentions ₹13.50 + GST.• Mutual Funds & IPOs: Both platforms allow you to apply for mutual funds and IPOs without any charges.