Bank of Baroda Eterna Credit Card

-

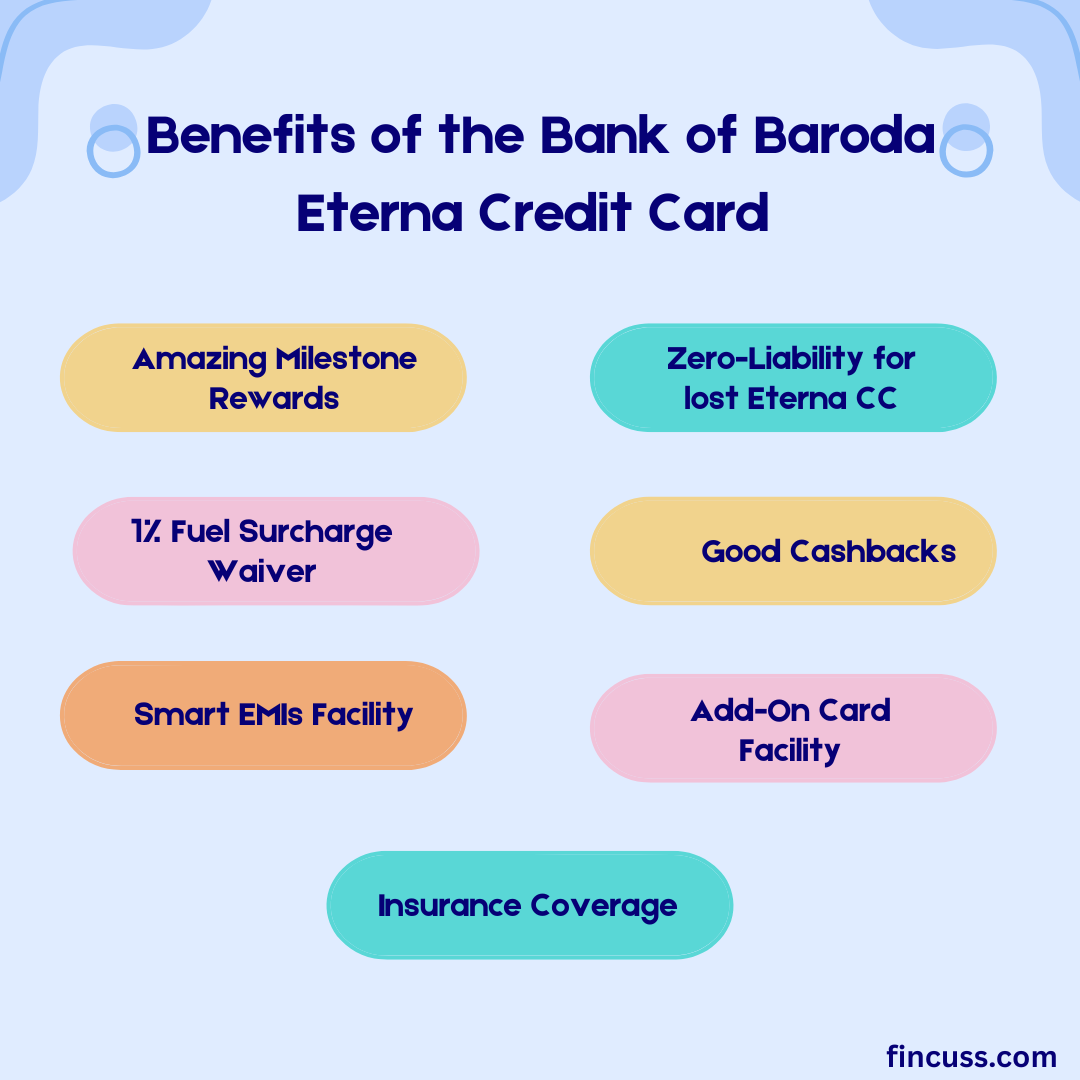

If you are looking for a credit card that truly understands your modern lifestyle and rewards you for your everyday spending, then the Bank of Baroda Eterna Credit Card offers premium benefits and practical savings tailored to your lifestyle, shopping, and travel needs. It's designed to enhance your financial experience.

Why Choose the BoB Eterna Card?

This isn’t just your average credit card; the Bank of Baroda has put a lot of thought into it, ensuring it brings real value across a range of spending categories.

-

Awesome Reward Points: For every ₹100 spent on shopping, travel, dining, or booking movie tickets, you’ll rack up 15 reward points. And don’t worry — for everything else, you still earn 3 points per ₹100. Each of these points is worth ₹0.25, meaning you can potentially save up to ₹3.75 for every ₹100 spent in the bonus categories.

-

Unlimited Lounge Access: Travel hassle-free with unlimited access to domestic airport lounges. Some sources say you get this without any strings attached, but others mention that you need to spend ₹40,000 in the previous quarter. Either way, this could mean serious savings throughout the year!

-

Great Welcome & Milestone Perks: Right off the bat, you'll snag a FitPass Pro membership valued at ₹15,000 for six months. Plus, spend ₹50,000 in the first 60 days, and you’ll receive 10,000 bonus points. If you hit ₹5 lakh in yearly spending, you’ll earn an extra 20,000 bonus points.

-

Movie Deals: If you're a movie lover, you’ll enjoy "Buy One Get One Free" movie tickets through Paytm, with a cap of ₹250 off per month. It’s a sweet deal for anyone who loves catching films.

-

Low Forex Fees: For those who travel abroad, this card has a low forex markup fee of just 2%, which is much better than many other options available.

Fees and Charges

- Joining Fee: ₹2,499 plus GST; it’s waived if you spend ₹25,000 in the first 60 days (GST isn’t reversed).

- Annual Fee: ₹2,499 plus GST; it’s waived if you spend ₹2.5 lakh in the previous year.

- Foreign Transaction Fee: 2% of the transaction amount, which is lower than what many cards charge.

- Cash Withdrawal Charges: 2.5% or a minimum of ₹500; it's best to avoid using your card for cash withdrawals.

- Interest Rate: 3.25% monthly; 3.49% if you don't pay your bill on time (that’s 41.88% annually).

- Cheque Bounce Charges: 2% of the cheque amount or a minimum of ₹450 (some say ₹300).

- Unblocking Charge: ₹300.

- Late Payment Charges: These vary based on how much you owe, ranging from nil to ₹950.

- Add-on Card Fee: Free for up to three lifetime add-ons.

- Reward Redemption Fee: None.

- Processing Fee on Wallet Loading/Utility: 1% for transactions over ₹50,000.

- Processing Fee on Fuel Transactions: 1% for transactions over ₹10,000.

Eligibility Overview

To get this card, the main applicant should be between 21 and 65 years old and have an annual income of ₹12 lakh or more.

How to Apply for the Bank of Baroda Eterna Credit Card

You can easily apply for the Bank of Baroda Eterna Credit Card either online or offline.

Online

- Head over to https://www.bobcard.co.in/ and select the Eterna Card.

- Click on 'Apply Now,' fill out the application form, and complete your KYC verification.

- The bank will get back to you within a few days.

Offline

- Drop by your nearest branch with the necessary documents to apply in person.

- Fill out the physical application form at the branch.

In a nutshell, the BoB Eterna Credit Card stands out for its awesome benefits, especially if you're a frequent traveler, movie lover, or just someone who enjoys earning rewards on day-to-day spending.

-