HDFC Bank Corporate Platinum Credit Card

-

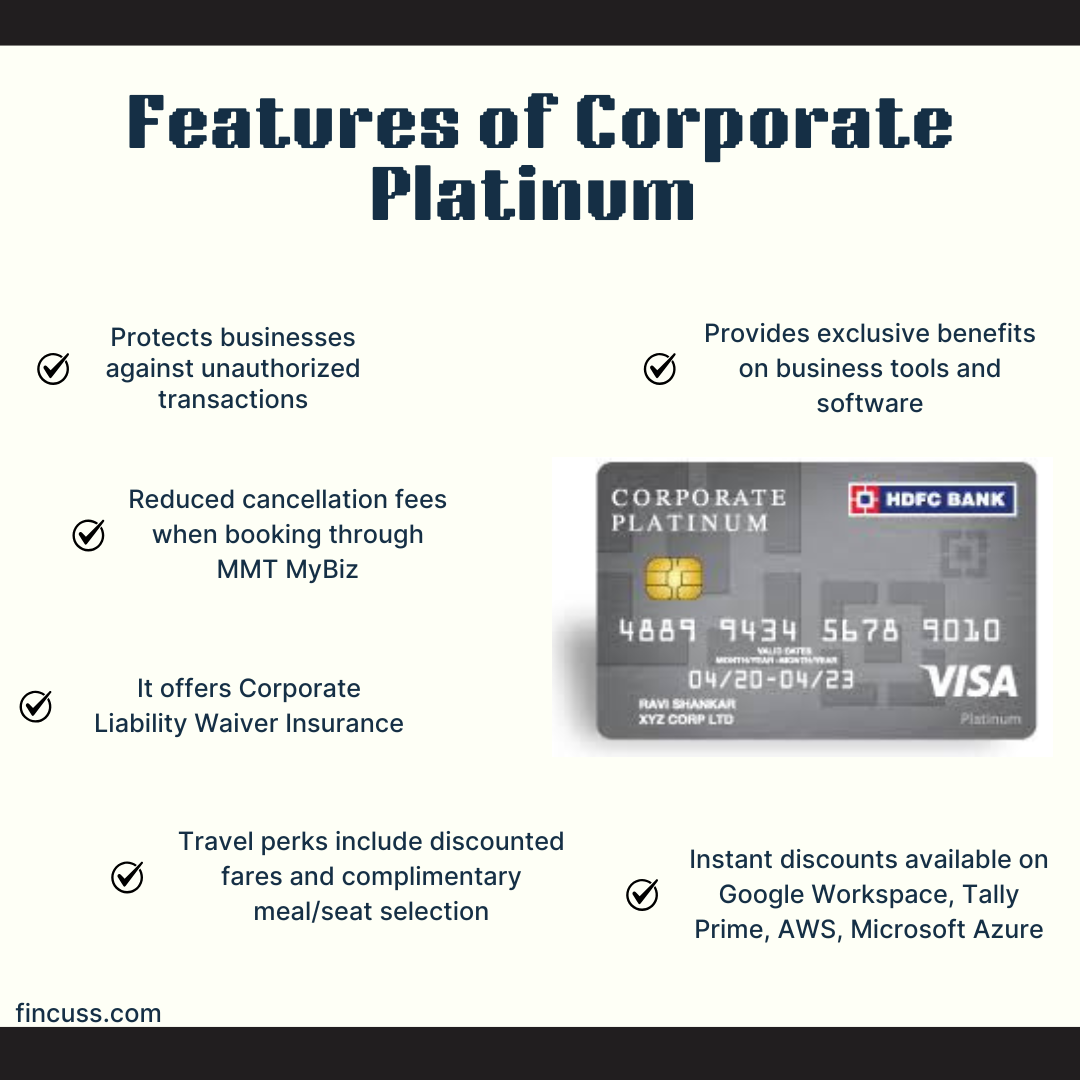

The HDFC Bank Corporate Platinum Credit Card is specifically crafted to streamline business operations and offer substantial benefits to corporate users. It is more than just a payment tool; it is a comprehensive solution for managing corporate expenses with ease and intelligence.

Key Benefits for Your Business

This card truly shines in its ability to empower businesses with smarter financial management:

- Enhanced reporting tools provide access to 60 customized expense reports for informed decision-making.

- Streamlined reconciliation reduces paperwork with consolidated global transaction reports for efficient processing.

- An interest-free credit period of up to 50 days allows for better negotiations and significant savings.

Exclusive Perks for Cardholders

Your team members using the card also enjoy a host of privileges:

- Rewarding Spends: Earn 3 Reward Points for every Rs. 150 spent, with a maximum of 6,000 points per statement cycle. These points are valid for two years and can be redeemed for airline tickets, hotel bookings, or from a diverse catalog.

- Domestic Lounge Access: Enjoy up to 8 complimentary domestic airport lounge visits annually.

- Comprehensive Protection: The card provides substantial insurance coverage, including Rs. 1 Crore for air accidental death and up to Rs. 1 lakh for emergency medical expenses when traveling outside your home country.

- Fuel Surcharge Waiver: Get a 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 5,000 across all petrol pumps, capped at Rs. 500 per statement cycle.

Important Card Details

- Annual Fee: The HDFC Bank Corporate Platinum Credit Card currently comes with no joining or annual fees.

- Foreign Currency Markup: A 3.5% markup applies to all foreign currency transactions.

Eligibility Criteria

- Applicants must be aged 21-65 for self-employed individuals and 21-60 for salaried individuals.

- Primary cardholders must reside in India; non-residents are not eligible.

- Add-on cardholders must be at least 15 years old.

- Applicants need a registered business with a stable income.

- Credit score is a significant factor for eligibility.

- Required documents include the application form, PAN, address proof, income proof, photographs, and ID.

- Corporate cards require additional business-related documents such as licenses and financial statements.

Conclusion

The HDFC Bank Corporate Platinum Credit Card is an excellent choice for businesses aiming to optimize expense management, enhance savings, and provide valuable travel and insurance benefits to their cardholders. It is truly designed to bring efficiency and privilege together, making it a powerful asset for any forward-thinking company.