Secure Your Savings: India's Top Health Insurance Plans for Indians.

-

India's healthcare system shows that emergencies can quickly use up savings. Surgical costs vary a lot, with brain surgery costing around ₹4 lakh and liver transplants going up to ₹25 lakh. Many people face serious health problems, including 1.5 crore cancer patients and 9 crore people with heart disease.

- Public health services have long wait times for procedures like MRIs.

- There are very few hospital beds available, only 0.5 for every 1,000 people.

- Health insurance is important for protecting your money from unexpected medical costs.

- It’s not just a cost; it’s a necessary investment in your health.

Decoding Health Insurance: Traps to Avoid

Choosing the right policy can be tricky. Be careful of common traps that insurers use to offer lower initial premiums:

-

Lower yearly premiums can lead to higher co-pays. For example, if you have a ₹5 lakh hospital bill, you might need to pay ₹1 lakh out of your own pocket.

-

If your insurance policy limits room rent to ₹5,000 per day but you choose a room that costs ₹7,000, you'll have to pay the extra ₹2,000 yourself. This could also raise the costs of other hospital services based on the higher room rate.

-

Some insurance policies may have low costs but limit claims for certain diseases. For instance, a ₹5 lakh plan might only cover ₹1 lakh for heart issues. This means you could face high out-of-pocket expenses for heart surgery that costs ₹3-5 lakh. Always check the details to avoid unexpected costs.

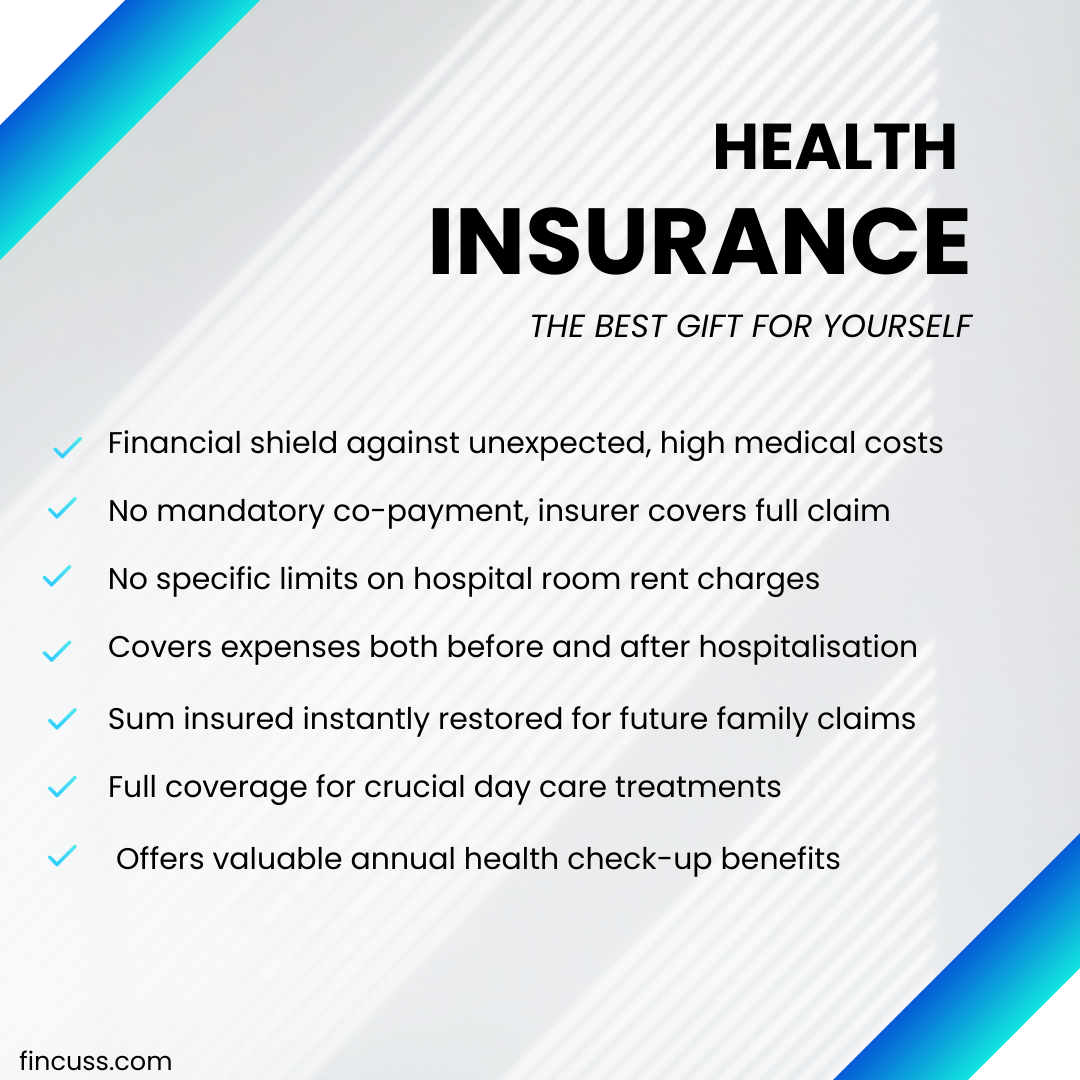

What to Look For in a Smart Policy

When choosing a plan, make sure it has these important features:- Pre and Post-Hospitalization Cover: This helps with costs before and after you stay in the hospital.

- Restoration Benefit: This is important for family plans; it restores coverage after one person makes a claim, so others can still use it.

- Day Care Treatments: This covers procedures that don’t need an overnight stay in the hospital, like dialysis or chemotherapy.

Making the Smart Choice

Here are the top 5 insurers in India for 2025:

HDFC Ergo is one of the biggest general insurance companies in India, and a large part of its business is in health insurance.

- HDFC Ergo has over 32 million happy customers.

- This number includes all types of insurance.

- They offer motor, home, and health insurance.

- The report shows their strong market presence.

ICICI Lombard is a top private general insurance company in India that focuses on using technology to provide better solutions.

- ICICI Lombard issued more than 21.7 million policies.

- The company settled 1.6 million claims.

- This shows a strong performance in the insurance market.

- ICICI Lombard has a large presence in India.

Tata AIG is a partnership between the Tata Group and American International Group (AIG). It is known for its wide range of health insurance products that can be customized.

- Tata AIG has a strong customer base.

- It offers a variety of products, including super top-up plans.

- The company is a leading player in the private sector.

- Tata AIG is recognized for its innovative features.

- These include riders for mental wellness and outpatient care.

Niva Bupa (formerly Max Bupa) is a health insurance company that operates on its own. This allows it to focus only on health products.

- The Council of Insurance Ombudsman (CIO) report covers the financial year 2023-24.

- Niva Bupa received 2,511 complaints, which is a high number among private insurers.

- Star Health had more complaints than Niva Bupa.

- Niva Bupa had 17 complaints for every lakh policyholders in 2023-24.

- This shows how well they handle customer service and claims.

Care Health Insurance is a well-known standalone health insurer recognized for its comprehensive plans and focus on family health.

- Care Health Insurance also received 2,511 complaints in the financial year 2023-24.

- This amounts to 16 complaints for every lakh policyholders.

- The complaint rate helps measure customer satisfaction.

When choosing health insurance options, always check:

• Claim Settlement Ratio: A higher ratio (for example, HDFC Ergo at 99%) shows better reliability.

• Network Hospitals: Make sure your preferred hospitals are part of their network.

• Trust and Support: Look for platforms like Ditto (backed by Zerodha) for unbiased, spam-free advice to help you find the right plan for your needs.Final Thoughts: Protect Your Future Today!

Don’t wait for a health crisis to realize the importance of health insurance. It's more than just a piece of paper; it protects your finances during medical emergencies. Taking action now, like getting a free consultation, can really make a difference.