The stock market is confusing: Let's break it down in simple terms

-

Investing in the stock market can feel overwhelming because of all the complicated terms and warnings. However, learning the basics is important for building your confidence as an investor. It's not a fast way to get rich, but it’s a way to grow your wealth over time with smart choices.

Let’s simplify the world of stocks and investing, so you can create a strong foundation and potentially grow your own wealth.

Decoding the Stock Market

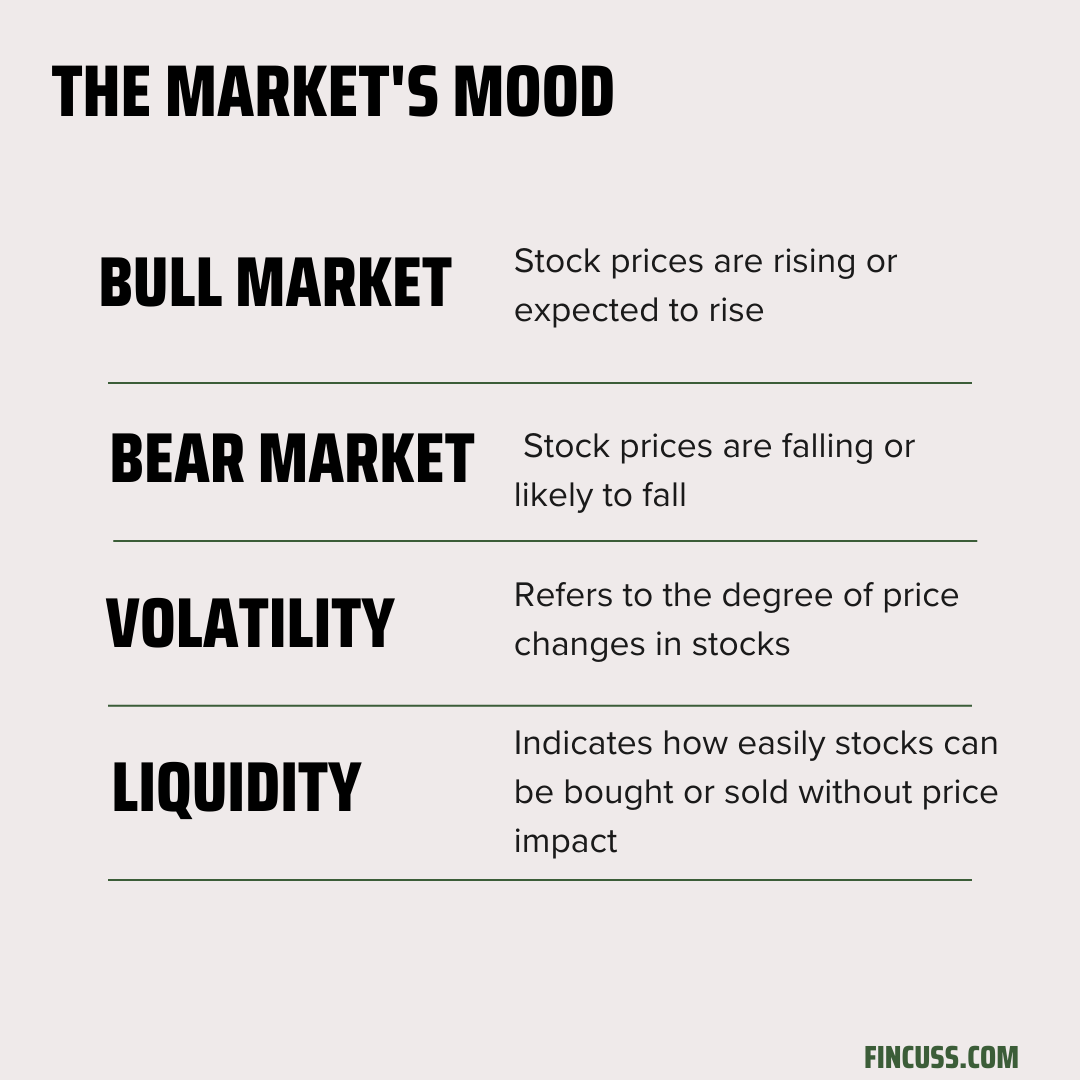

The stock market is where people buy and sell parts of companies. Here are some important terms to help you understand:

• Stock (or Share): Your Ownership

When you buy a stock, you own a small part of a company, making you a co-owner.• Stock Exchange: The Trading Place

This is where stocks and other securities are bought and sold. Examples include the New York Stock Exchange (NYSE) and India's National Stock Exchange (NSE). You can buy or sell shares here.• Portfolio: Your Investment Collection

Your portfolio includes all your investments, like stocks, bonds, mutual funds, and other assets.• Dividend: Profit Sharing

Some companies pay part of their profits to shareholders as dividends, so you earn money just for owning their stock.• IPO (Initial Public Offering): Going Public

An IPO happens when a private company sells its shares to the public for the first time. Companies do this to raise money from the public instead of just banks or friends.

Key Company Metrics: Understanding Business Health

Knowing these terms can help you evaluate individual companies:

-

Market Capitalization (Market Cap): Company Size

Market cap is the total value of a company's shares. You calculate it by multiplying the stock price by the number of shares. Companies are categorized as large-cap, mid-cap, or small-cap based on their size. -

Blue-Chip Stocks: Reliable Choices

Blue-chip stocks come from large, well-known companies that consistently perform well. They are generally seen as safer investments. -

EPS (Earnings Per Share): Profit Overview

Earnings Per Share (EPS) shows how much profit a company makes for each share. It’s calculated by dividing net profit by the total number of shares. -

P/E Ratio (Price-to-Earnings Ratio): Value Check

The Price-to-Earnings (P/E) Ratio helps you compare a company's stock price to its earnings per share. It’s useful for determining if a stock is overpriced or a good buy.

Is the Stock Market Risky? What Returns Can You Expect?

- Stock market investments carry risks similar to any business investment.

- Poor company performance can lead to quick losses, but risks may yield good returns.

- Long-term investments can significantly increase wealth, like ₹10,000 in Wipro turning into ₹700 crore.

- In India, smart long-term investors may see 18-20% annual returns, better than Fixed Deposits.

- Some investors achieve up to 30% returns, even in slower economies.

- The stock market is a marketplace for buying and selling shares.

- The National Stock Exchange (NSE) is a major trading platform in India.

- Companies sell shares to raise money, giving buyers a stake in the company.

- Daily trading involves millions of people and over 4,000 companies.

- Investor sentiment influences market trends, impacting prices during Bull and Bear Markets.

How to Get Started with Investing?

You don’t need a ton of cash to start investing. You can kick things off with just ₹1,000 a month and even ramp it up by 15% each year. If you stick with it, that could grow to ₹1 crore after 25 years thanks to compounding!

- Opening an investment account is easy and online.

- You need three documents: Aadhaar card, PAN card, and bank info.

- Discount brokers like Zerodha offer low or no fees.

- Account setup takes about three to four days.

- You won't face heavy taxes when investing.

Who is responsible for share market in India

- The Stock Exchange is where stocks and securities are traded, like India's NSE.

- Companies list shares to raise capital, allowing public investment and ownership.

- Millions of buyers and sellers actively trade shares, ensuring market liquidity.

- Investor sentiment affects market conditions, swinging between optimism in Bull Markets and fear in Bear Markets.

Investing in the stock market can help you build wealth, but it takes some knowledge and patience. So, don’t chase after quick profits; take the time to learn about the companies you’re interested in. Think of investing as a long-term commitment. With a little understanding and some patience, you’ll feel way more confident as an investor!

-