Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

-

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), launched in 2015, offers affordable life insurance. This scheme aims to provide financial security to the poor and middle class, ensuring that every household has a safety net against uncertainties.

What Exactly is PMJJBY?

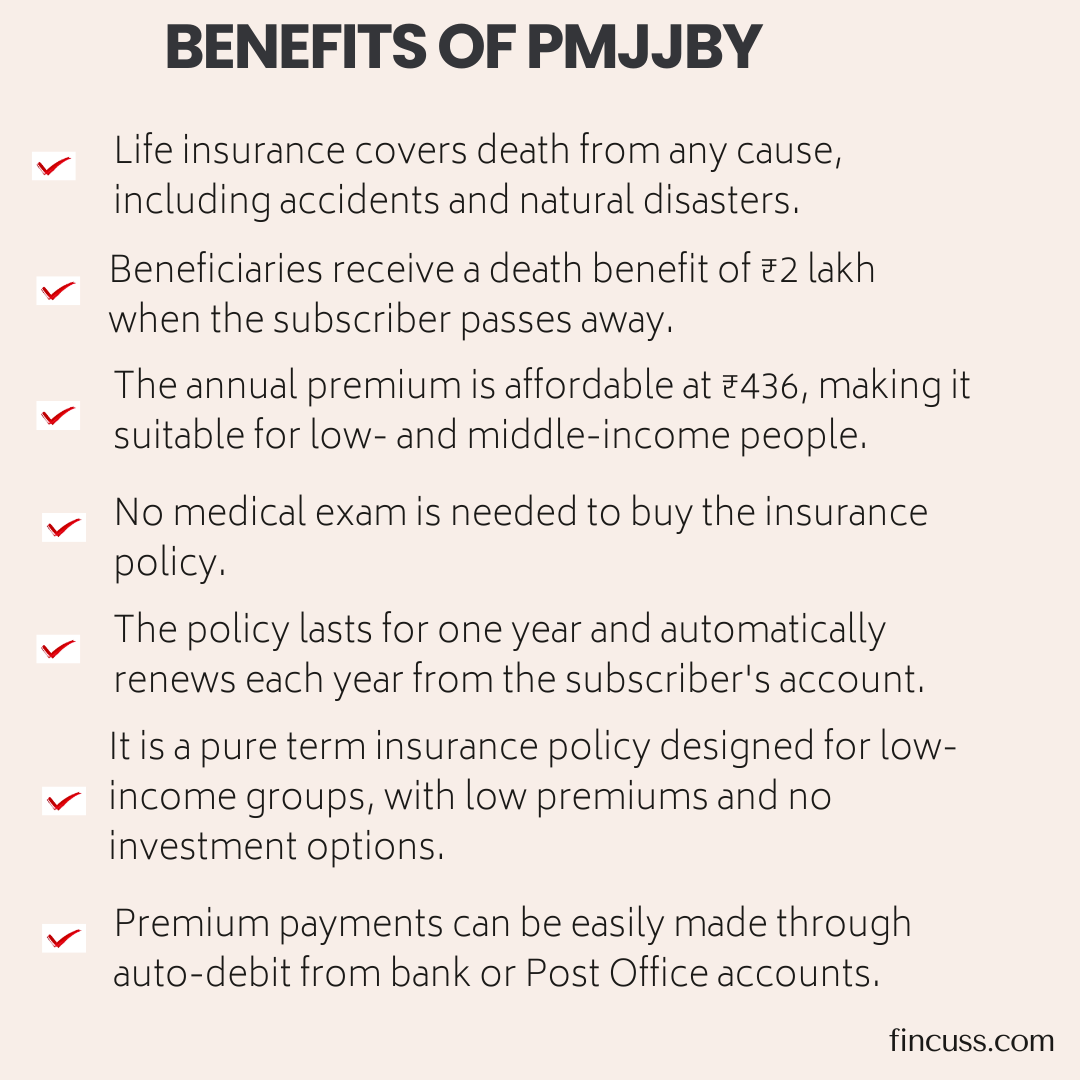

PMJJBY is a one-year renewable term life insurance scheme. It focuses solely on mortality risk without investment components. The scheme offers low premiums, making it attractive to many individuals.

Current Data

- Total enrolments in PMJJBY exceed 23.6 crore since its inception.

- Claims settled amount to approximately ₹18,398 crore, benefiting over 9 lakh families.

Eligibility Criteria

- Age limit: Participants must be aged 18 to 50; coverage ends at 55.

- Eligible accounts: Only holders of participating bank or post office accounts can join, linked to Aadhaar.

- Auto-debit consent: Subscribers must consent to auto-debit for premium payments.

- One policy rule: Individuals can only enroll through one account; duplicates are restricted to ₹2 lakh.

- Joint accounts: All joint account holders may join if they meet the criteria and pay premiums.

- NRIs eligible: Non-Resident Indians can join with an Indian bank account; claims are paid in INR.

- No medical exam: No medical examination is required for insurance purchase.

- Joining later: Eligible individuals can join or rejoin in subsequent years by paying premiums.

First-time enrollees or rejoining individuals have a 30-day lien period without death coverage, excluding accidents.

How do I apply for PMJJBY?

To apply for the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), you can follow these steps:

- Visit a bank or post office to apply for PMJJBY.

- Use digital banking for the application if available.

- Fill out the PMJJBY application form in your preferred language.

- Provide the necessary documents: Aadhaar, PAN card, photo, signature, and mobile number.

- Give consent for the auto-debit of the annual premium of ₹436.

- Submit the completed application form to the bank.

- Receive confirmation via SMS or email after policy activation.

Insurance coverage starts upon premium auto-debit; a 30-day lien period applies for new enrollees.

You can apply for the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) at any bank or post office where you have an individual account.

Final Thoughts

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) offers affordable life insurance for Indians. The scheme eliminates complex paperwork and medical exams, making it accessible through bank or post office accounts with auto-debit options. It reflects the government's dedication to providing financial security for poor and middle-class families, helping them cope with unexpected events without facing financial hardship.

Don't wait; secure your family's future today with PMJJBY – a small step for you, a giant leap for their security.